The global vacuum gas oil (VGO) market size reached around USD 406.80 Billion in 2024. The market is projected to grow at a CAGR of 5.30% between 2025 and 2034, to reach nearly USD 681.81 Billion by 2034. This growth trajectory highlights VGO's integral role in refining operations, especially as global demand for cleaner fuels and advanced processing intensifies.

What is Vacuum Gas Oil (VGO)?

Vacuum Gas Oil, commonly referred to as VGO, is a heavy oil derived from the vacuum distillation unit (VDU) in crude oil refineries. VGO is a crucial feedstock for further refining in secondary conversion units such as catalytic crackers and hydrocrackers, where it’s broken down into lighter, more valuable fractions like gasoline, diesel, and jet fuel.

VGO can be classified into two types:

Light Vacuum Gas Oil (LVGO) – with lower boiling points and higher hydrogen content.

Heavy Vacuum Gas Oil (HVGO) – with higher molecular weights and boiling points.

Given its strategic importance in petroleum refining, VGO plays a pivotal role in addressing the global fuel demand across sectors, including transport, power generation, and industry.

Key Market Drivers

1. Rising Demand for Clean and Efficient Fuel

One of the primary drivers for the VGO market is the increased global emphasis on producing cleaner fuels. VGO serves as a key input for hydrocracking processes, which convert heavy oils into ultra-low sulfur diesel and high-octane gasoline—fuels aligned with strict emission regulations worldwide.

2. Expanding Global Refining Capacities

Countries like China, India, and Saudi Arabia are expanding their refining infrastructure to cater to rising domestic and export demand. This expansion increases the need for vacuum distillation units and, consequently, boosts the demand for VGO as an essential feedstock.

3. Growth in Transportation Sector

The transportation sector remains one of the largest end-users of refined petroleum products. Surging automobile ownership, rising freight movement, and increased air travel globally are contributing to higher consumption of gasoline and jet fuels, thereby driving demand for VGO-derived outputs.

4. Technological Advancements in Refining

Advancements in catalytic cracking and hydrocracking technologies have made the processing of VGO more efficient. Enhanced conversion rates, improved catalyst life, and reduced operational costs have made the use of VGO more economically viable.

Market Challenges

Despite its optimistic growth, the VGO market faces several hurdles:

Stringent Environmental Regulations: Growing environmental concerns and the global shift toward decarbonization are creating pressure on traditional oil refining. Policies encouraging electric vehicle adoption and the use of biofuels could reduce demand for VGO over time.

Volatility in Crude Oil Prices: As VGO is a byproduct of crude oil, its availability and pricing are directly influenced by fluctuations in global crude prices, affecting refining economics and investment decisions.

Capital-Intensive Infrastructure: Establishing and maintaining complex refining infrastructure with VGO-compatible hydrocrackers and catalytic crackers requires high capital investment, especially in developing regions.

Regional Insights

North America

North America remains a significant player in the VGO market. The United States, with its large network of complex refineries, accounts for a major share of global VGO consumption. Additionally, the shale oil boom has boosted crude supply, enabling refiners to optimize feedstock blends with VGO.

Asia-Pacific

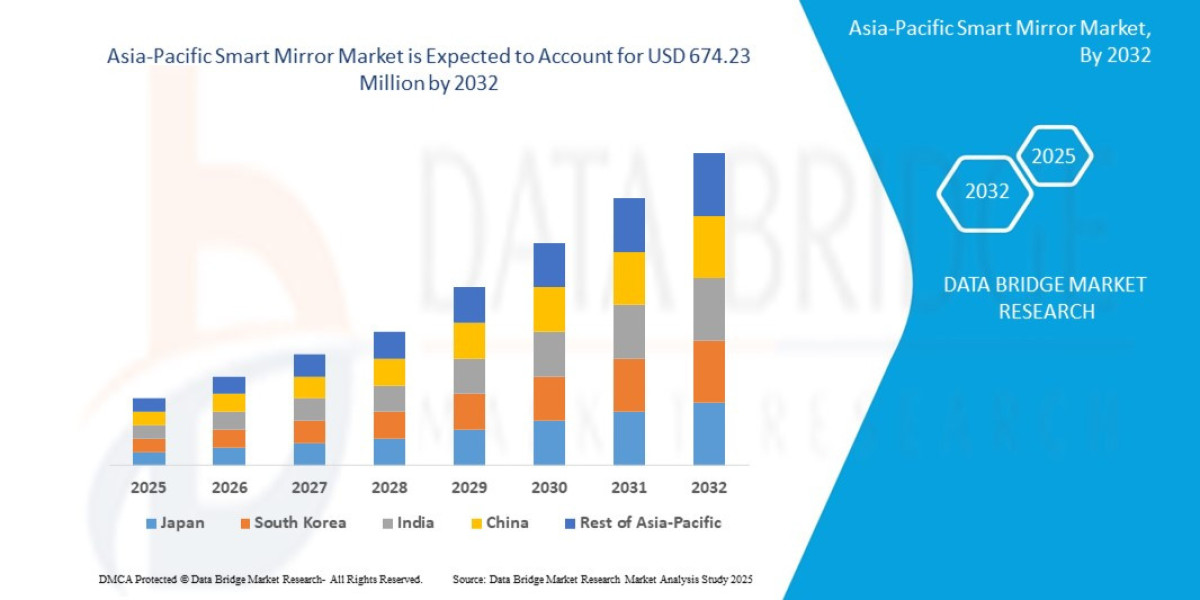

The Asia-Pacific region is expected to witness the fastest growth, led by countries like China, India, and South Korea. Rapid industrialization, urbanization, and the expansion of the middle class have led to a rise in demand for transportation fuels and petrochemical products, thereby pushing VGO consumption.

Middle East & Africa

With vast crude oil reserves and plans to increase refining capacity, countries in the Middle East are focusing on downstream development. VGO will be a crucial component in new integrated refining and petrochemical projects aimed at diversifying oil-dependent economies.

Europe

Europe has been more cautious, with several countries transitioning to greener alternatives. However, the need for low-sulfur fuels still supports demand for VGO in hydrocracking operations, especially in maritime sectors where IMO 2020 regulations are strictly enforced.

Opportunities in the VGO Market

Integration with Petrochemical Manufacturing: The demand for ethylene, propylene, and other petrochemical derivatives is growing. Refiners are increasingly integrating petrochemical units into their operations, where VGO can be upgraded to valuable feedstocks for these products.

Bio-Based Alternatives and Co-processing: Innovations in co-processing VGO with bio-oils and waste oils are being explored to reduce the carbon intensity of fuels, opening up sustainable pathways for VGO utilization.

Investments in Developing Economies: Countries in Africa and Southeast Asia are witnessing foreign direct investments in refining infrastructure. These regions are potential hotspots for VGO demand over the next decade.

Future Outlook

The global VGO market is poised for robust growth, driven by the dual forces of rising fuel demand and technological advancements in refining. While sustainability concerns present long-term challenges, the medium-term outlook remains strong due to the continued relevance of gasoline and diesel in the global energy mix.

To thrive in this evolving landscape, industry stakeholders need to:

Invest in R&D for cleaner refining processes

Diversify feedstock sources

Leverage digital technologies for refinery optimization

Align with regulatory and ESG frameworks