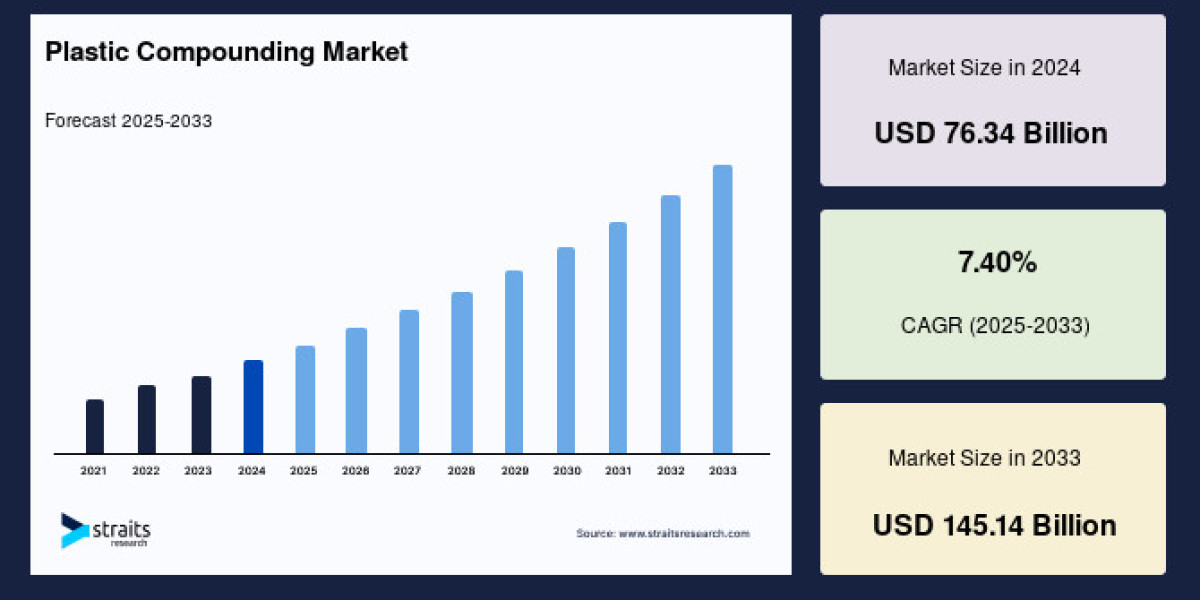

Market Size and Growth Outlook

The global plastic compounding market size was valued at USD 76.34 billion in 2024 and is projected to reach from USD 81.99 billion in 2025 to USD 145.14 billion by 2033, growing at a CAGR of 7.40% during the forecast period (2025-2033).

Asia-Pacific is the dominant region in this market, accounting for roughly 45–56% of global revenue, with China and India emerging as key contributors.

Key Growth Drivers

Automotive and Transportation Industry

The demand for lightweight and fuel-efficient vehicles is generating strong interest in polypropylene-based compounds. Compounded plastics contribute to energy savings, increased durability, and enhanced performance in parts like bumpers, interior panels, and trims. These features are driving growth in both internal combustion and electric vehicle segments.

Construction, Packaging, and Consumer Electronics

Compounded plastics are increasingly used in insulation, piping, cables, consumer appliances, electrical housings, and packaging applications due to their durability, moldability, and impact resistance.

Industrialization in Emerging Economies

Rapid industrial development in countries like China, India, and Southeast Asia is boosting demand across multiple sectors. The rise of consumer goods, infrastructure, and electronics industries is fueling the need for advanced plastic compounds.

Sustainability and Eco-Friendly Innovation

There is increasing emphasis on bio-based and recycled sources. Companies are innovating with biodegradable polymers and recycled-content compounds as regulatory pressure and sustainability consciousness grow.

Sample report @ https://straitsresearch.com/report/plastic-compounding-market/request-sample

Market Segmentation

By Product Type

Polypropylene (PP) represents the largest segment, holding approximately 35% share, due to its cost-effectiveness and suitability for automotive and packaging applications. Polyethylene (PE) follows, comprising around 28–27% of the market. Other significant types include Polyvinyl Chloride (PVC), Polyamides (PA), thermoplastic elastomers, polycarbonates, ABS, PET, and various specialty polymers.

By Application Sector

The automotive & transportation sector accounts for the largest share, nearly 30–26% of the market. Building & construction and packaging sectors follow at roughly 25% and 20% respectively. The fastest-growing segment is electronics & appliances, driven by demand for lightweight, heat-resistant materials.

By Source

The majority of compounding materials are fossil-based (over 50%), supported by extensive industrial use. The bio-based and recycled segments are smaller but growing rapidly in response to circular economy goals.

By Geography

Asia‑Pacific leads the market, followed by North America (~20%), Europe (~18%), Middle East & Africa (~9–10%), and Latin America (~8%).

Segmentation availbale @ https://straitsresearch.com/report/plastic-compounding-market/segmentation

Regional Insights

Asia-Pacific

This region dominates thanks to large-scale manufacturing, particularly in China and India, where growth in automotive, construction, packaging, and electronics sectors drives demand. India’s rising middle class and consumer goods production further support expansion.

North America & Europe

These regions feature steady growth fueled by automotive, consumer durables, medical, and infrastructure demand. Europe has strong regulatory motivation toward sustainable materials and recycling, driving innovation in bio-based compounding.

Latin America, Middle East & Africa

Emerging industrialization, urban infrastructure projects, and increasing consumer electronics use are developing demand, though regional shares remain modest compared to Asia-Pacific.

Trends and Strategic Drivers

Sustainability Push: Growing demand for biodegradable and recycled plastics is prompting companies to develop eco-conscious compounds.

Advanced Additives: Use of flame retardants, UV stabilizers, fillers, and reinforcement agents is expanding to tailor performance properties.

Technological Innovation: Adoption of twin-screw extrusion, compounding automation, and R&D on high-performance PA and engineering plastics are accelerating.

Resilience to Raw Material Volatility: Input price fluctuations, particularly in crude-derived feedstocks, are creating cost-control strategies and localized sourcing.

Customization for Specialized Applications: Demand for compounds with thermal, electrical, or mechanical performance enhancements is rising across end-use industries.

Challenges and Opportunities

Challenges

Regulatory pressure over single-use plastics and waste management norms

Volatile raw material pricing and feedstock availability

Need for continuous R&D investment to meet evolving application standards

Market competition and margin pressures

Opportunities

Expansion of bio-based and recycled plastic compounding lines

Growing automotive electrification and electronics demand in emerging markets

Infrastructure expansion in Asia-Pacific offering compounding volumes

Innovation in engineering plastics for aerospace, medical, and specialty applications

Overview of Key Market Players

Straits Research identifies several leading companies operating at a global or regional level, including large integrated chemical producers and specialized compounding firms:

LyondellBasell Industries

BASF SE

SABIC

Celanese Corporation

Covestro AG

ExxonMobil Chemical Division

INEOS Group

Clariant AG

DuPont

3M (Dyneon)

RTP Company

Asahi Kasei Corporation

Versalis (Eni)

Chevron Phillips Chemical

Eastman Chemical

Others

These players lead in production volume, geographic footprint, sustainability innovation, and product portfolios.

Having query ask @ https://straitsresearch.com/buy-now/plastic-compounding-market

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services, along with providing business insights & research reports.

Contact Us:

email: [email protected]

Website: https://straitsresearch.com/