The global unsaturated polyester resin price trend has garnered considerable attention in recent years due to its significant role across multiple end-use industries such as automotive, construction, marine, and electrical. Understanding the market dynamics surrounding these resins is essential for manufacturers, procurement professionals, and strategic planners.

This article delves into key price movements, market forecasts, regional insights, and historical data—offering an all-encompassing view of the unsaturated polyester resin market. By integrating real-time trends and comprehensive insights, this analysis is crafted to support better decision-making for stakeholders operating in this critical segment of the chemicals industry.

What is Unsaturated Polyester Resin?

Unsaturated polyester resin (UPR) is a thermosetting polymer obtained by the condensation of polyols with unsaturated dicarboxylic acids. These resins are typically combined with a crosslinking monomer, such as styrene, and then cured with catalysts or accelerators. UPR is renowned for its excellent mechanical properties, chemical resistance, and affordability, making it ideal for use in fiber-reinforced plastics (FRP) and non-reinforced applications.

Global Unsaturated Polyester Resin Market Overview

The global demand for UPR is closely linked to infrastructure development, consumer goods production, and environmental regulations. Industries such as wind energy, marine transportation, and electrical enclosures rely heavily on UPR composites. Hence, even slight shifts in global economic activity, raw material availability, or energy prices can significantly influence the unsaturated polyester resin price trend.

Unsaturated Polyester Resin Price Trend Analysis

Understanding the unsaturated polyester resin price trend involves examining a range of variables, including:

- Crude oil fluctuations (impacting raw materials like styrene and maleic anhydride)

- Global supply-demand imbalances

- Trade regulations and import-export dynamics

- Downstream industry growth or contraction

- Regional production costs and energy prices

Historical Pricing Data

Historical data shows that UPR prices have seen cyclical fluctuations over the past decade. From periods of high growth spurred by demand from emerging economies, to slumps triggered by global events such as the COVID-19 pandemic, the price behavior has reflected broader macroeconomic patterns.

For example, UPR prices surged in 2021 due to supply chain disruptions, rising raw material costs, and heightened demand from the wind energy and automotive sectors. Conversely, temporary slowdowns in construction in 2023 slightly deflated market expectations.

Forecast Price Movement

Looking forward, the unsaturated polyester resin price trend is expected to stabilize in the medium term, barring any significant geopolitical or supply-side disruptions. Increasing investments in infrastructure projects across Southeast Asia, Africa, and the Middle East will support demand, while innovations in bio-based resins could affect traditional UPR consumption.

The forecast period from 2025 to 2030 will also likely see a gradual shift in price determinants—from pure cost-push factors to more sustainability-driven premiums and quality differentiation.

Regional Insights and Market Segmentation

The UPR market is geographically diverse. Key producing regions include China, the United States, India, and Europe, while consumption is widespread due to the versatility of the resin.

Asia Pacific

Asia Pacific dominates the UPR market, both in terms of production and consumption. Rapid urbanization, construction booms, and automotive production are key demand drivers. China, in particular, has been instrumental in setting the unsaturated polyester resin price trend due to its scale of manufacturing and raw material access.

Europe

European markets focus on high-performance and environmentally compliant resins. Stringent environmental regulations often lead to higher production costs, which can elevate UPR prices compared to other regions. The drive toward sustainability and the use of recyclates may further influence market pricing.

North America

North America maintains a strong demand base, particularly in the aerospace, automotive, and renewable energy sectors. The region also sees increased imports from Asian suppliers, making it sensitive to global shipping costs and currency exchange rates.

Latest News and Market Developments

Recent market developments shaping the price trend include:

- Regulatory changes in the EU regarding VOC emissions are influencing demand for low-styrene UPR formulations.

- Supply chain realignments as companies nearshore manufacturing to reduce geopolitical risk and transport costs.

- Increased M&A activity, with major players acquiring regional UPR producers to expand footprint and reduce cost per unit.

- Emergence of bio-based UPRs, though still a small share, is beginning to affect traditional resin pricing through R&D investments and patent licensing models.

Procurement Challenges and Strategic Sourcing

Navigating the procurement of unsaturated polyester resin requires a nuanced understanding of price trends, supplier reliability, and contract structuring. Companies that rely heavily on UPR as a raw material need to factor in:

- Lead times and transport costs

- Raw material indexation

- Supplier diversification

- Currency fluctuation hedging

Working with a trusted Procurement Resource can aid in mitigating risk through customized price forecasting tools, supplier audits, and dynamic sourcing strategies. These insights enable businesses to remain competitive while ensuring consistent supply.

Market Database and Historical Data Access

Reliable databases provide access to historical trends that span across several years, segmented by grade, region, and end-use industry. These databases allow analysts to:

- Identify cyclical pricing behavior

- Correlate prices with macroeconomic indicators

- Project future trends using statistical models

Databases also include supplementary metrics such as freight rates, raw material indexes (like styrene monomer, maleic anhydride), and comparative pricing across substitute materials like epoxy resin and vinyl ester resin.

Market Insights: Opportunities and Constraints

Opportunities:

- Growth in renewable energy and infrastructure creates fresh demand.

- Development of low-VOC and recyclable UPR products.

- Rising demand from the marine and aerospace industries for lightweight composites.

Constraints:

- Price volatility in raw materials due to oil dependency.

- Environmental scrutiny and regulations around styrene use.

- Competition from other thermoset resins with better mechanical properties in some applications.

Understanding these factors is essential for those looking to capitalize on favorable pricing or hedge against market risk.

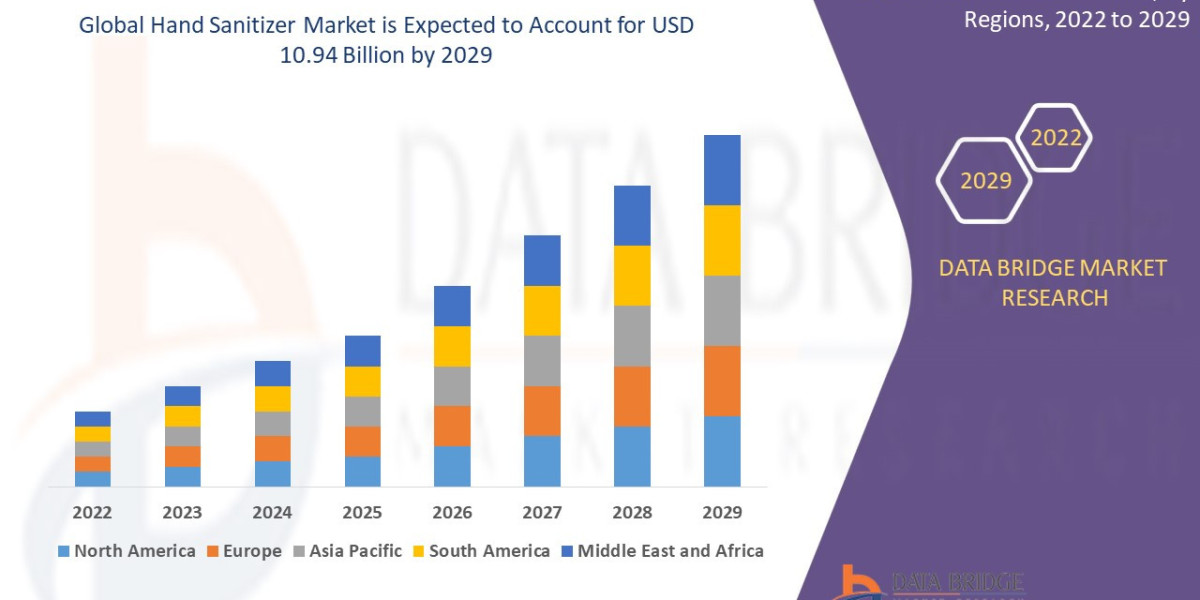

Charts & Visual Trend Mapping

For visual learners and data-driven stakeholders, accessing detailed charts that map out:

- Monthly pricing movements

- Year-on-year changes

- Regional comparisons

- Cost-to-manufacture ratios

…offers a strategic advantage when forming long-term procurement contracts or exploring new supplier partnerships.

Forecast Models and Predictive Analytics

Integrating AI-powered models and predictive analytics helps companies anticipate price movements and plan accordingly. These models factor in:

- Global economic indicators

- Trade patterns

- Energy and commodity prices

- Manufacturing cost indices

Such forecasting enables proactive inventory management and strategic budgeting.

Request for the Real Time Prices: https://www.procurementresource.com/resource-center/unsaturated-polyester-resin-price-trends/pricerequest

Contact Information

Company Name: Procurement Resource

Contact Person: Ashish Sharma (Sales Representative)

Email: [email protected]

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

USA: +1 307 363 1045

UK: +44 7537171117

Asia-Pacific: +91 1203185500